The advantages of hiring an independent insurance agency abilene tx for flexible policies

Leading Reasons You Must Have Insurance for Comprehensive Protection

In today's uncertain world, having insurance is greater than an option; it is a need. It offers a safety and security internet versus unanticipated clinical expenses, residential property damages, and potential responsibility claims. This security expands beyond private needs, affecting services and their ability to thrive. Understanding the multifaceted benefits of insurance can greatly alter one's approach to risk and security. The question stays: just how can one really make best use of the benefits of substantial coverage?

Financial Safety And Security Versus Unforeseen Medical Costs

While unforeseen medical expenses can produce significant financial strain, detailed insurance offers a vital security internet (independent insurance agency abilene tx). People frequently undervalue the possible prices linked with clinical emergencies, from hospital remains to specialized treatments. Without appropriate insurance coverage, even a solitary occurrence can cause frustrating financial obligation, impacting total monetary stability

Thorough health insurance serves to mitigate these risks, making sure that people can access required medical treatment without the concern of inflated out-of-pocket costs. By pooling resources, insurance makes it possible for members to share the economic load of unanticipated wellness concerns, advertising satisfaction.

Having insurance urges prompt medical focus, which can avoid minor problems from intensifying into serious health and wellness situations. This proactive approach not only safeguards individual financial resources yet additionally boosts total well-being. Eventually, durable wellness insurance is an important element of financial security, offering people with the guarantee that they can face unforeseen medical obstacles without devastating effects.

Security for Your Assets and Residential property

Possessions and home represent considerable investments that call for defense versus various threats, consisting of burglary, natural catastrophes, and accidents. Without sufficient insurance policy protection, people and businesses may deal with significant economic losses that might threaten their stability. Home insurance offers a safeguard, making certain that in case of damages or loss, the costs of fixings or replacements are covered. This insurance coverage can reach homes, lorries, and useful individual belongings, protecting financial investments versus unpredicted events.

:max_bytes(150000):strip_icc()/how-does-insurance-sector-work.asp-FINAL-1ccff64db9f84b479921c47c008b08c6.png)

Liability Insurance Coverage to Protect Your Future

Liability insurance coverage plays an essential function in providing lawful security versus possible lawsuits and claims. It ensures that individuals and companies can browse unexpected conditions without risking their monetary security. By purchasing considerable liability insurance, one safeguards not just their assets yet likewise their future security.

Legal Security Conveniences

A complete insurance coverage policy typically consists of crucial lawful defense benefits that serve to protect people versus prospective obligations. These advantages can cover lawful costs occurring from legal actions, ensuring people are not economically overwhelmed by unforeseen legal battles. In most cases, lawful depiction is essential when one deals with accusations of carelessness or misconduct. Insurance plan might additionally give access to lawful guidance, aiding people navigate complicated lawful matters more effectively. Additionally, legal defense advantages can reach negotiations or judgments, using peace of mind in the occasion of unfavorable end results. By incorporating these legal securities, individuals can protect their future versus the uncertainties of legal disagreements, allowing them to concentrate on their personal and specialist lives without consistent fear.

Financial Safety And Security Assurance

Substantial insurance plans usually consist of essential economic protection assurance, specifically through robust liability coverage that secures people from unexpected financial worries. This kind of insurance coverage safeguards versus lawful cases occurring from accidents or carelessness, guaranteeing that insurance holders are not left at risk to possibly terrible costs. By giving a financial security internet, liability coverage helps preserve security in individual and professional lives, enabling individuals to browse challenges without debilitating monetary strain. In addition, it promotes assurance, knowing that unanticipated conditions will not derail future plans or investments. Inevitably, having detailed responsibility protection is click here now a prudent selection, making it possible for individuals to concentrate on their quests and responsibilities while being ensured of protection against significant financial risks.

Satisfaction in Times of Situation

How can one find solace amidst the chaos of unexpected obstacles? In times of dilemma, the weight of unpredictability can be frustrating. Insurance coverage offers a crucial layer of protection, permitting people and families to navigate unstable waters with higher self-confidence. Understanding that monetary support is offered throughout emergencies reduces anxiety, enabling a more clear concentrate on healing and restoring.

When unforeseen events occur, such as crashes or all-natural catastrophes, the emotional toll can be considerable. Insurance minimizes this worry by supplying confidence that losses will be resolved, whether through property insurance coverage or health and wellness benefits. This assurance equips individuals to make educated decisions, promoting strength in the face of adversity. Inevitably, having insurance indicates embracing a complacency, allowing one to encounter life's unpredictability with a steadier heart and a clearer mind, all set to challenge difficulties head-on.

Assistance for Business Continuity and Growth

While maneuvering the complexities of business landscape, companies rely upon insurance not only for defense however also for cultivating connection and growth. Insurance policy works as a security web that allows organizations to recuperate swiftly from unanticipated occasions, such as natural catastrophes or crashes. This financial backing reduces the dangers that can or else halt procedures or bring about considerable losses.

Furthermore, having substantial insurance facilitates calculated preparation and investment. With a strong insurance structure, organizations can discover brand-new ventures and expand their operations with confidence, knowing they have a protect in position. This safety and security motivates innovation and the pursuit of lasting objectives, as companies really feel encouraged to make computed dangers.

Fundamentally, insurance is an integral element of a durable service method, making it possible for firms to browse difficulties while maintaining concentrate on development and sustainability. By focusing on substantial protection, organizations place themselves for sustaining success in an ever-evolving market.

Accessibility to Resources and Knowledge in Emergency Situations

Accessibility to resources and experience during emergency situation circumstances is important for businesses facing unexpected obstacles. Insurance policy supplies a safety web that links firms to a network of experts outfitted to handle crises effectively. This network includes risk monitoring click for info experts, legal advisors, and specialized recovery groups.

In minutes of distress, services take advantage of instant access to professional support, allowing them to browse complex scenarios with confidence. Insurers frequently supply sources such as dilemma management strategies and training sessions, boosting a business's readiness.

Furthermore, insurance can promote prompt recovery by offering economic sources to mitigate losses and quicken remediation initiatives. This guarantees that services can promptly go back to regular procedures, lessening downtime and maintaining consumer count on.

Regularly Asked Concerns

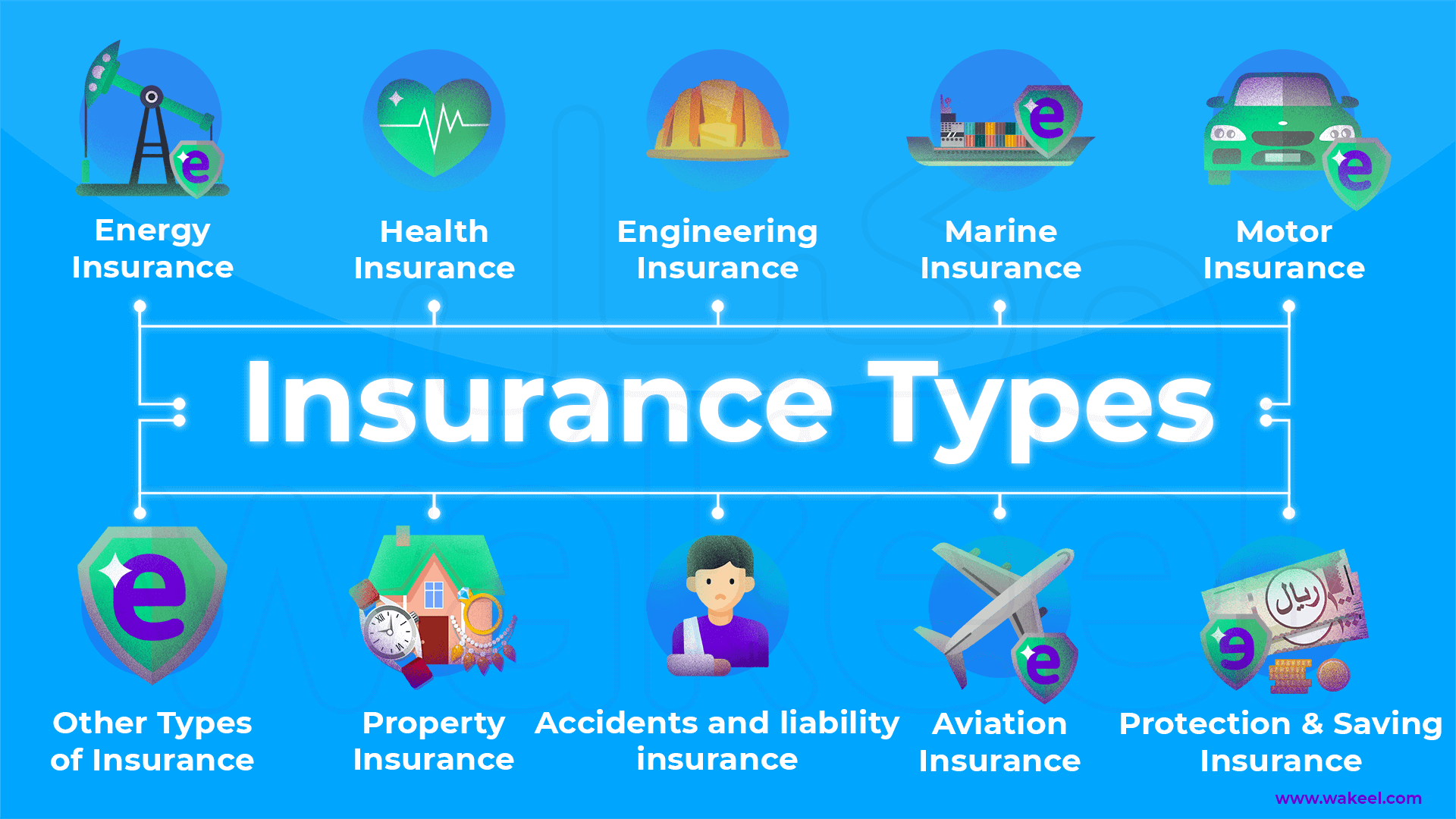

What Sorts of Insurance Are Important for Comprehensive Defense?

The crucial kinds of insurance for comprehensive defense typically include health, car, house owners, and life insurance. Each offers to alleviate economic dangers connected with unforeseen occasions, guaranteeing people are appropriately guarded versus different potential liabilities.

How Does Insurance Impact My Overall Financial Planning?

Insurance significantly influences overall monetary planning by reducing dangers and prospective losses. It allows people to designate resources a lot more successfully, ensuring financial stability learn the facts here now and assurance while preparing for unanticipated events that can interrupt economic goals.

Can I Tailor My Insurance Plan for Specific Needs?

The individual asked about tailoring insurance plans to satisfy specific demands. Insurance policy suppliers often provide flexible alternatives, permitting clients to customize coverage, limits, and deductibles, making certain placement with personal scenarios and financial objectives.

What Prevail Misconceptions Concerning Insurance Protection?

Numerous individuals mistakenly think that all insurance plans coincide, that they don't require protection until an occurrence takes place, or that considerable security is expensive. These misunderstandings can bring about poor monetary safety and security.

Exactly how Typically Should I Testimonial My Insurance Plan?

Evaluating insurance plans every year is recommended to assure protection stays ample. Changes in individual circumstances, market conditions, or plan terms might necessitate modifications - car insurance company abilene tx. Regular analyses assist individuals preserve suitable security and stay clear of potential voids in protection